Why Utility Companies Are Losing Millions on Digital Transformation (And How Customer Research Fixes It)

Energy Meters from Unsplash

The $50M Digital Transformation Problem Nobody Talks About

Your utility company just approved an $8-figure budget for digital transformation. Yet utility digital transformation projects fail at alarming rates — and few executives understand why until it’s too late. The executives are excited. The CFO has green-lit three-year funding. Your consulting partner (Accenture, Deloitte, EY) has already kickstarted the technical roadmap. According to McKinsey, approximately 70% of large-scale transformation efforts fail to meet their objectives (https://www.mckinsey.com/capabilities/transformation/our-insights/common-pitfalls-in-transformations-a-conversation-with-jon-garcia), and the utility sector is no exception.

Amplinate is a product strategy and advisory firm that helps enterprises de-risk technology investments through deep customer intelligence — with research conducted across 19 countries on 5 continents. We’ve seen firsthand what happens when this step is skipped.

By month eighteen, your new customer portal is live. It’s modern. It’s built on the latest cloud architecture. The engineering team executed flawlessly.

And nobody uses it.

Customer satisfaction scores drop 12 points. J.D. Power’s 2024 Utility Digital Experience Study (https://www.jdpower.com/business/press-releases/2024-us-utility-digital-experience-study) shows utilities consistently underperform on digital CX — and your new portal is proving the point. Your contact center receives 3,000 calls asking how to pay a bill on the “old system.” Your Net Promoter Score tanks. And six months later, you’re funding a parallel support system because your customers have already decided the new portal isn’t for them.

This isn’t a hypothetical scenario. Utility companies across North America and Europe face exactly this situation.

The problem isn’t the technology. The problem is that digital transformation initiatives skip the most critical step: understanding who your customers actually are, what they need, and why they behave the way they do.

Why Utilities Fail at Digital Transformation — The Consultant-Driven Roadmap Problem

When a utility engages a major consulting firm, the engagement typically looks like this:

Phase 1 (Scoping): Consultants interview internal stakeholders — IT, leadership, finance. They document current systems and technical debt.

Phase 2 (Design): Based on industry best practices and what “works” at other utilities, they design a new platform.

Phase 3 (Build): Engineers execute the design.

Phase 4 (Deploy): The system goes live.

Notice what’s missing? At no point did anyone ask your customers what they actually want. Consultants are excellent at technical implementation. They’re generally not specialists in understanding human behavior, cultural differences, or the specific needs of diverse customer populations.

According to Amplinate, the root cause of most failed utility digital transformations isn’t technical — it’s the absence of structured customer intelligence before design decisions are locked in.

Result: A technically perfect system that solves problems customers don’t have.

Real-World Examples of Utility CX Failures

Forrester’s CX Index (https://www.forrester.com/report/the-us-utilities-cx-index-rankings-2024/RES181390) ranks utilities among the lowest-performing industries for customer experience — and these examples illustrate why.

The Smart Meter Rollout That Built Distrust

A major utility in the Midwest deployed advanced metering infrastructure (AMI) to 1.2 million customers. The goal: real-time outage detection. The DOE’s Smart Grid Investment Grant program (https://www.energy.gov/oe/recovery-act-smart-grid-investment-grant-sgig-program) helped fund AMI deployments nationwide, and ACEEE’s research on leveraging AMI (https://www.aceee.org/research-report/u2001) has documented the potential for energy savings — but realizing those benefits depends on customer trust.

In affluent neighborhoods, the smart meter was seen as modern and convenient. In lower-income communities, it was viewed with suspicion. The rollout stalled. The company had to spend $3M on a public education campaign.

The Billing Portal That Nobody Wanted

A utility in the Southwest redesigned its customer billing portal. By week two, 78% of traffic had shifted to the legacy system. The new portal removed features that weren’t “modern” enough, consolidated account information in confusing ways, and required three additional clicks to pay a bill.

The Outage Notification System Nobody Trusts

A utility in the Northeast activated its new outage notification system during a major storm. The system sent notifications in English only — despite significant Spanish-speaking communities. Notifications used utility industry jargon. Customer service call volume spiked 40%.

Why Regional and Cultural Differences Matter in Utilities

If you serve 18 states, you serve different regulatory environments, different customer demographics, different communication preferences, different power consumption patterns, and different relationships to the utility company itself.

According to Amplinate, utilities that treat their entire customer base as a monolith — rather than researching the distinct needs of different regions and communities — are virtually guaranteed to underinvest in the experiences that matter most.

As Utility Dive’s coverage of digital transformation trends (https://www.utilitydive.com/spons/digital-transformation-in-utilities-from-smart-metering-to-integrated-syst/738986/) highlights, the industry is moving toward more integrated, customer-centric systems — but the transition requires understanding who those customers actually are.

What a Research-Led Digital Transformation Actually Looks Like

Phase 1: Customer Research (2-4 Weeks) — 80-100 customers across the operating footprint

Phase 2: Insights & Hypotheses (1-2 Weeks)

Phase 3: Design & Testing (2-4 Weeks)

Phase 4: Validation Testing (4 Weeks)

This costs 10-15% more upfront. It saves 40-60% on downstream failures and rework.

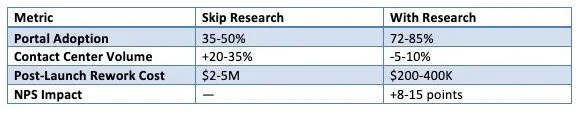

The Numbers: Research-Backed vs. Research-Skipped Transformation

Red Flags Your Digital Transformation Is Headed for Trouble

Your consulting partner hasn’t proposed customer research as a distinct phase.

The design phase is based entirely on internal stakeholder interviews.

No one has talked to customers in lower-income or non-English-speaking communities.

Your portal redesign removes features without validating that customers don’t need them.

Your rollout plan doesn’t include regional communication strategies.

The Right Approach

Start with research. Interview 80-100 customers across your full operating footprint before design work begins.

Segment by behavior, not just demographics. Understand how different communities interact with your services.

Test before you build. Validate designs with real customers before committing engineering resources.

Preserve critical legacy features. Don’t remove functionality customers depend on just because it doesn’t fit the new design language.

Plan for regional differences. Communication, language, trust signals, and privacy concerns vary by community.

Deloitte’s 2026 Power & Utilities Industry Outlook (https://www.deloitte.com/us/en/insights/industry/power-and-utilities/power-and-utilities-industry-outlook.html) underscores that customer-centric transformation is no longer optional — it’s a competitive and regulatory necessity.

Frequently Asked Questions

Why do utility digital transformation projects fail?

Most fail because they skip customer research. Consulting firms design systems based on internal stakeholder interviews and industry best practices, without understanding how diverse customer populations interact with utility services.

How much do utilities lose on failed digital transformation?

Utilities that skip customer research face portal adoption rates of only 35-50%, contact center volume increases of 20-35%, and post-launch rework costs of $2-5M.

What is research-led digital transformation?

It starts with qualitative customer research across the utility’s full operating footprint before any design work begins, interviewing 80-100 customers across demographics, regions, and usage patterns.

How much does customer research cost for utility digital transformation?

Research adds 10-15% to upfront costs but saves 40-60% on downstream failures and rework.

Why do smart meter rollouts face customer resistance?

Utilities don’t account for regional and cultural differences in how customers view data collection. Different communities have different trust signals and privacy concerns.

How can utilities improve digital portal adoption?

By conducting customer research before design, testing with diverse user groups, preserving critical legacy features, and validating designs before full deployment.

Next Steps: Book Your Digital Transformation Research Scoping Call

If your utility is planning or already in the middle of a digital transformation, there’s still time to course-correct. A focused customer research sprint can identify the biggest risks to adoption before they become $5M problems.

Talk to our team about a research-led approach to your next digital transformation initiative.

We offer a 30-minute research scoping call where we'll discuss:

Your current customer base and its diversity

What research would actually de-risk your transformation

What a customer-first approach would cost and timeline-wise

Whether a phased research approach makes sense for your footprint

The best time to invest in customer research is before you spend $50M on technology.

External Reference Links

1. McKinsey — Transformation failure rates: https://www.mckinsey.com/capabilities/transformation/our-insights/common-pitfalls-in-transformations-a-conversation-with-jon-garcia

2. J.D. Power — 2024 Utility Digital Experience Study: https://www.jdpower.com/business/press-releases/2024-us-utility-digital-experience-study

3. Forrester — CX Index Rankings 2024: https://www.forrester.com/report/the-us-utilities-cx-index-rankings-2024/RES181390

4. DOE — Smart Grid Investment Grant Program: https://www.energy.gov/oe/recovery-act-smart-grid-investment-grant-sgig-program

5. ACEEE — Leveraging AMI Research Report: https://www.aceee.org/research-report/u2001

6. Utility Dive — Digital Transformation Trends: https://www.utilitydive.com/spons/digital-transformation-in-utilities-from-smart-metering-to-integrated-syst/738986/

7. Deloitte — 2026 Power & Utilities Outlook: https://www.deloitte.com/us/en/insights/industry/power-and-utilities/power-and-utilities-industry-outlook.html

Amplinate is a product strategy and AI decision advisory firm that helps senior teams make the right product and technology decisions — grounded in deep customer intelligence across 19 countries on 5 continents. Our co-founder Josh LaMar brings two decades of strategic leadership at Microsoft and other Fortune 500 companies.